Do you remember the last time you took a picture with an analogue, non-digital camera? Chances are that this is quite some time ago. The younger generation doesn‘t even know what we are talking about…

The digital camera was a disruptive innovation to the photo industry. It has replaced the traditional, analogue camera. Formerly, established players such as Kodak or Leica have dominated the value chain. They have either disappeared or been restructured. Today, there are manufacturers such as Sony or Canon but it is us, the consumer, who records, develops, modifies and stores images based on their own taste.

The Automotive Disruption

The electric vehicle is a disruptive technology to the automotive industry. Such as the digital camera has dramatically changed the photo industry, the electric vehicle will dramatically change the automotive industry:

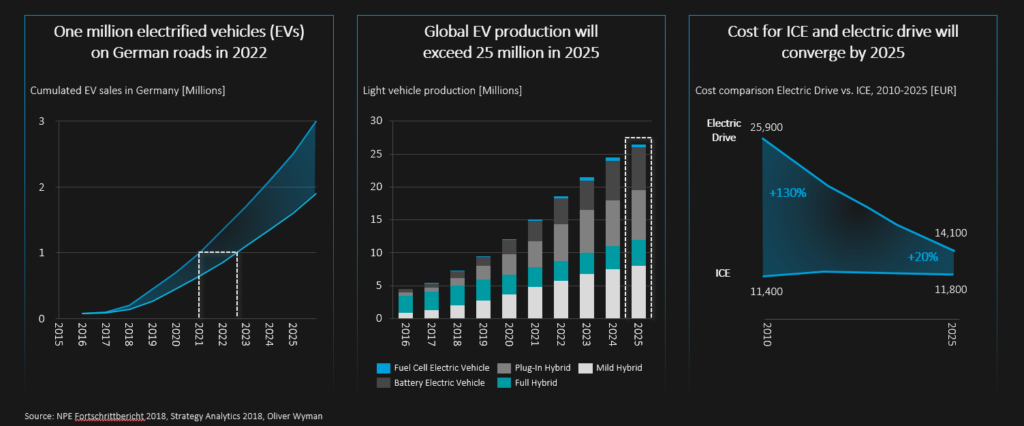

- We won‘t make the original goal of 2020, but in 2022 there will be one million electrified vehicles (EVs) on German roads

- We will produce more than 25 million EVs on a global level by 2025

- And in the same time horizon, we will see cost for internal combustion engine (ICE) and electric drive converge

The automotive disruption

What does that mean for manufacturers (OEMs) and suppliers?

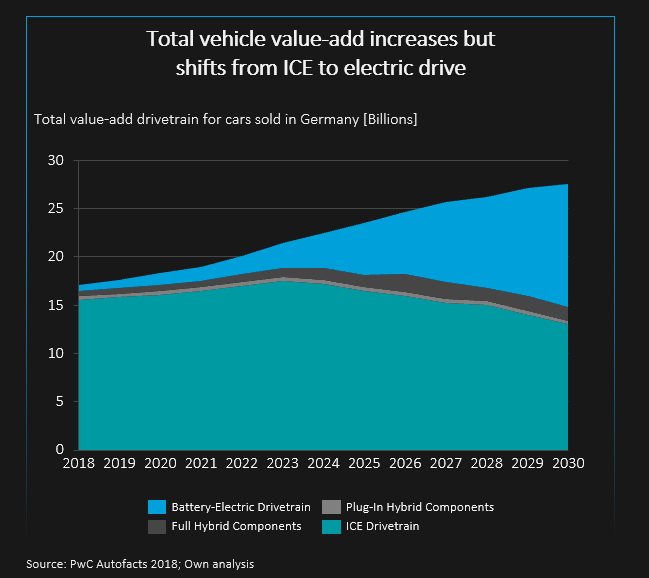

Until 2030 we will see a major shift in value-add from ICE to electric drive. This will result in major changes for OEMs: upstream on the supplier side and downstream at the customer interface.

Shift in value-add from ICE to electric drive

Upstream we will see the supplier base change significantly since numerous components will disappear and new components, especially the battery, will be added. Since the battery is such a key component, we expect OEMs to increase their vertical integration and insource huge parts of the battery value creation.

Downstream, we are already seeing a multitude of new players emerging that compete with and threaten OEMs at the customer interface: innovative manufacturers (e.g. Tesla), consumer electronics companies (e.g. Samsung, LG), utilities, tech giants (e.g. Google, Amazon) and mobility service providers (e.g. Uber). That‘s why we expect services such as battery service contracts, mobility and payment services to play a crucial role because they usually guarantee direct customer contact.

While this is rather an external market view, internally the new and additional components will massively increase complexity in the vehicle development process.

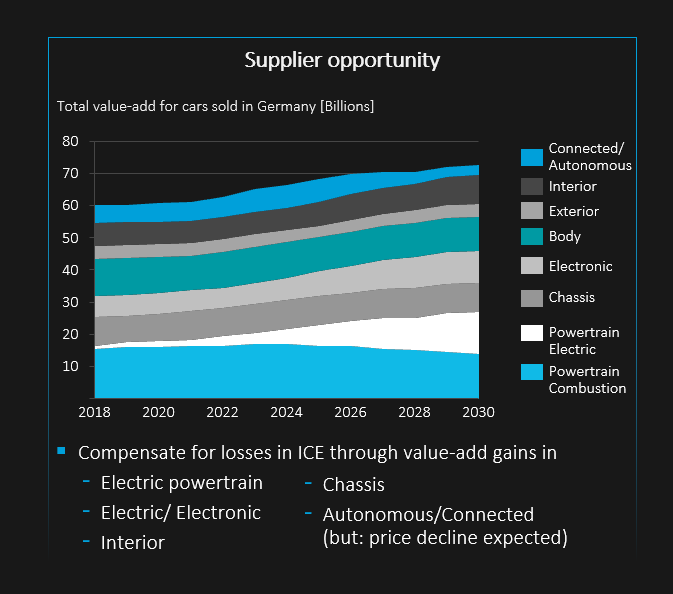

On the supplier side, this development will put significant pressure on current suppliers. We already mentioned that important components are eliminated, changed or added:

- eliminated: combustion engine, exhaust

- changed: gear box, transmission

- added: battery, electrics, power electronics

OEMs will try to reduce component cost by disaggregating certain modules and by insourcing components such as the battery pack. Moreover, most suppliers are forced to invest in existing technology (e.g. ICE improvement) and new technology at the same time.

So is it a desperate situation? No, here comes the good news: total value creation for the car will increase, not decrease. Therefore suppliers can make up for losses in ICE in future key components such as electric powertrain, electric/ electronic, interior and connected/autonomous.

Total value creation by component cluster

OEM business models in a disrupted world

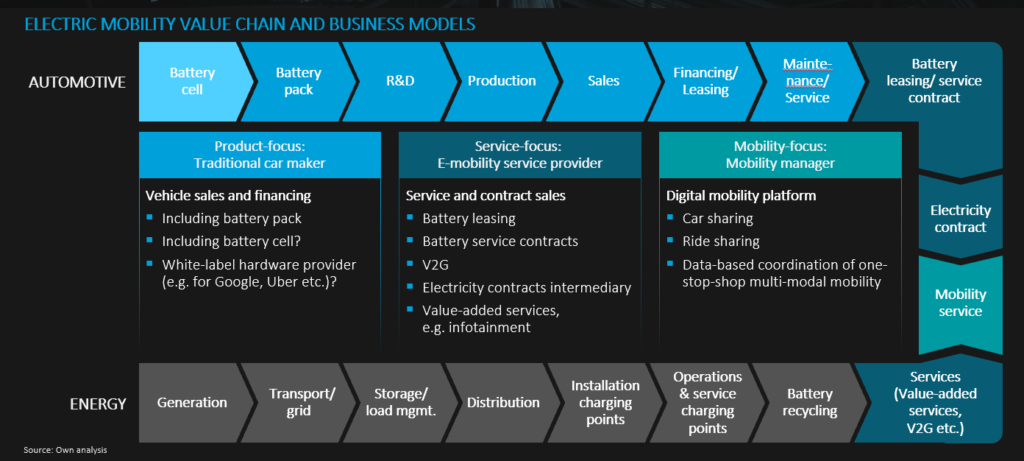

Coming back to the OEMs, how will future business models in the new world look like? The chart below shows the electric mobility value chain as a merge between the classic automotive and the energy value chain. Classic focus for the automotive industry is the upper part where we can see the battery as the most important component, followed by R&D, production, sales and after sales for the vehicle. Several further elements are added towards the customer interface, especially battery leasing, electricity contracts as well as mobility and energy services.

The electric mobility value chain

Three general business models will be found in the future marketplace. The product-focused car maker is very close to the traditional OEM plus battery pack. The open question is if and how much OEMs will be involved in the value creation at battery cell level. There is a controversial discussion regarding a European battery cell production. This is worth a discussion on its own. The rather threatening scenario is the OEM as white-label manufacturer that produces non-branded cars for other players at the customer interface, e.g. Google or Uber.

The e-mobility service provider is close to the customer and offers battery leasing, battery service contracts, V2G services, electricity contracts and value-added services such as infotainment. The mobility manager provides mobility services based on a digital mobility platform. This can include car sharing, ride sharing and other services that coordinate multi-modal mobility for the customer.

The disruption has gained momentum

So is this only theoretic strategizing? No, in all fields the disruption has already started. On product level, Volkswagen will invest 30 billion in electric mobility until 2022. CEO Diess: “We want to become the global number one in electric mobility.”

Regarding e-mobility services, German minister of transport claimed one billion Euro for private charging stations. Sven Scheuer: “We need subsidies of 1 billion Euro for installing charging points in private homes.”

And for mobility, Daimler and BMW announced to spend one billion on a mobility joint venture featuring services in five areas: multimodal, charging, ride-hailing, car sharing and parking.

So what’s next?

Leave a Reply